PART I

Item 1. Business.

Overview

Fathom Realty LLC was originally founded in January of 2010 and later incorporated as Fathom Holdings Inc. in the state of North Carolina on May 5, 2017. We are a national, technology-driven, real estate services platform integrating residential brokerage, mortgage, title, insurance, and Software as a Service ("SaaS”) offerings to brokerages and agents by leveraging our proprietary cloud-based software, intelliAgent. The Company’s brands include Fathom Realty, Dagley Insurance, Encompass Lending, intelliAgent, LiveBy, Real Results, and Verus Title.

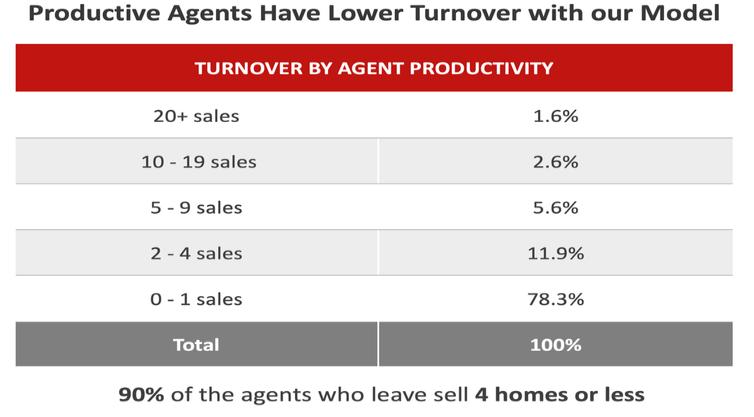

For our core business, Fathom Realty, our low-overhead business model leverages our proprietary software platform for management of real estate brokerage back-office functions, without the cost of physical brick and mortar offices or of redundant personnel. As a result, we are able to offer our agents the ability to keep significantly more of their commissions compared to traditional real estate brokerage firms; we do not split our agents’ commissions, but rather charge a flat fee per real estate transaction. We believe we offer our agents some of the best technology, training, and support available in the industry. We also offer our agents valuable benefits, including equity in our Company if they achieve revenue and growth goals, as well as what we believe is relatively broad and affordable healthcare coverage in many of our markets. We believe our commission structure, business model, advanced technology offerings, and our focus on treating our agents well attract more agents and higher producing agents to join and stay with our Company.

Fathom Realty’s commission model is designed to empower real estate agents to build a more profitable business by allowing them to keep a high percentage of their commission without sacrificing support, technology, or training. We believe that by simply joining our company, agents from traditional model brokerages can increase their income by over 25% on average. More importantly, agents are able to take that increase and reinvest it into their marketing thereby increasing their number of transactions and revenue which also benefits Fathom.

Generally speaking, there are only two ways to make more money in real estate: increase revenue or decrease expenses. In a slowing housing market, it’s difficult to increase revenue when agents are fighting over a piece of a smaller pie. Our low flat transaction fee provides agents money to outspend their competition on marketing while netting the same amount of money as an agent at a traditional brokerage. With our low flat transaction fee, even during a decline in the housing market where home sales decline by 20%, we believe most real estate agents can net as much income as they did the year before at a traditional brokerage. In other words, they may close 20% fewer homes but could earn the same income as before. We believe this can prove to be a tailwind for Fathom while it could be a headwind for many traditional brokerages.

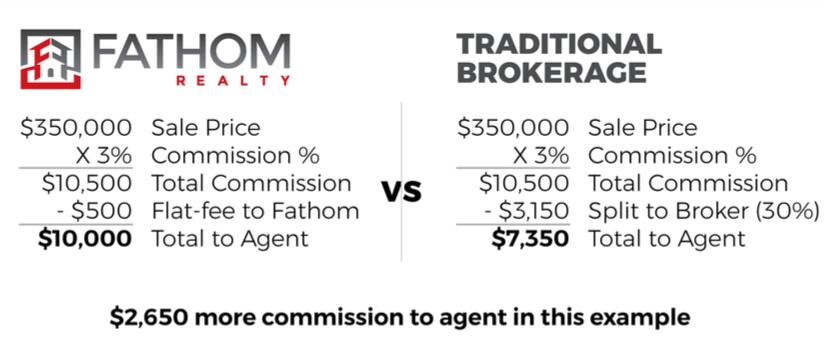

Traditional brokerage companies retain between 20% and 50% in commission splits from their agents. Below is an example of a traditional brokerage company’s commission model assuming a 30% split, versus our commission model. This is an example of potential commission savings, and results similar to the example below are not guaranteed.

6